Clean hydrogen play targets commercial output in 2024

February 1st, 2023Perth-based clean hydrogen player Infinite Green Energy is aiming to produce commercial-scale green hydrogen by the end of 2024 after it completed an $8 million acquisition of a solar farm in Western Australia and signed an offtake agreement.

Infinite Green Energy, chaired by former Woodside chief executive Peter Coleman, could become Australia’s first commercial-scale producer of green hydrogen should the plans materialise, which would mark a major milestone for the nascent energy source.

Green hydrogen as an energy source is hotly contested. While some see it as a viable alternative to fossil fuels, others say that to produce it in significant volumes would require vast sources of renewable energy. As a result, the green hydrogen industry has yet to take off.

Still, many expect hydrogen as a fuel source to grow, though the timeline to reach large-scale commercialisation remains the subject of debate.

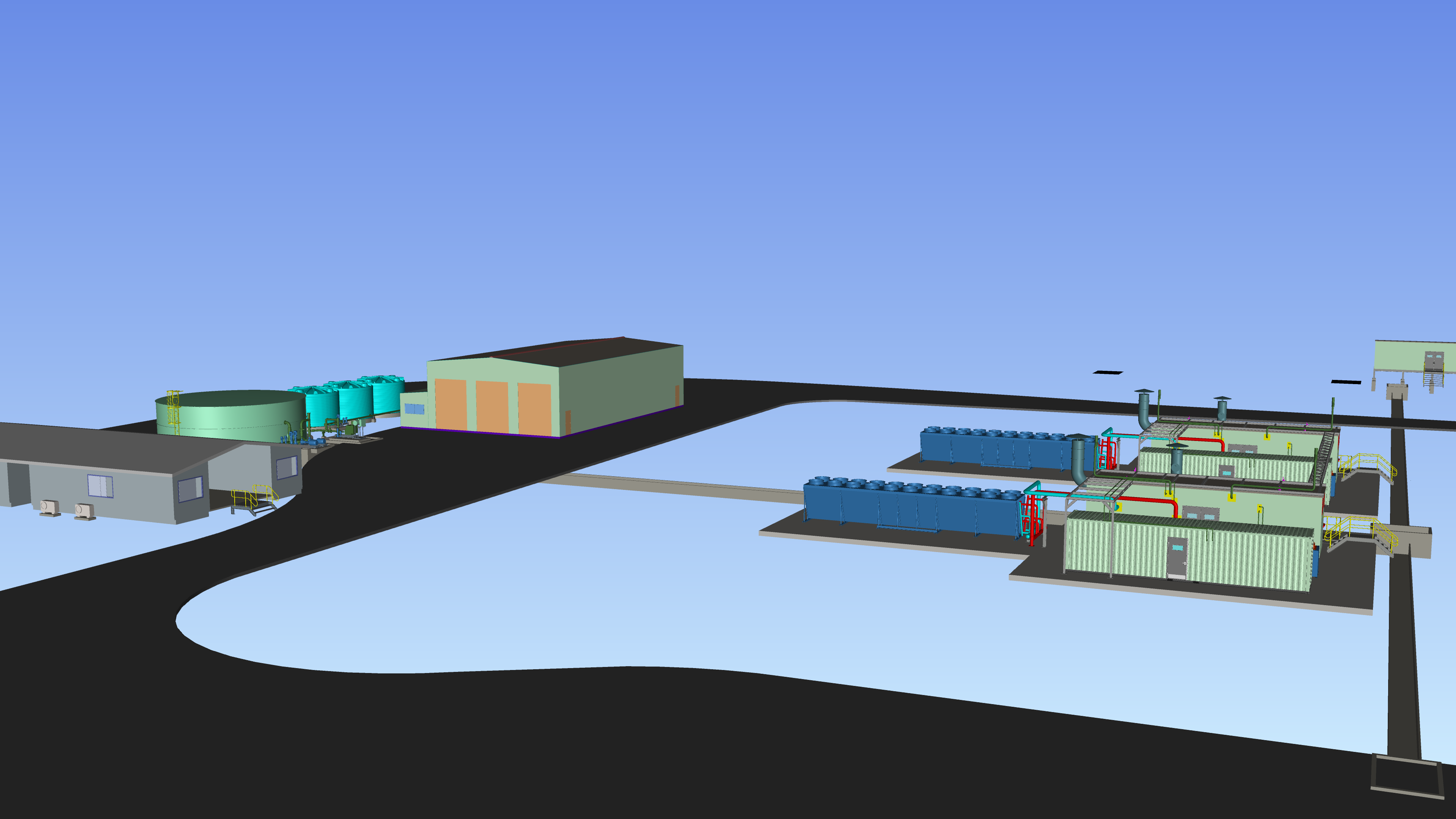

Looking to kick-start the sector, IGE plans to install electrolysers at the 11MW solar farm, about 100 kilometres north-west of Perth, with the aim of producing four tonnes a day of green hydrogen in 2024.

Some production would then be sold to haulage business Fuel Cell Electric Vehicle as part of an offtake agreement to fuel heavy transport.

The solar facility has the scale to be expanded to 18MW, with the capacity of producing eight tonnes of green hydrogen daily, Mr Coleman said.

He said the development of the green hydrogen facility would demonstrate the viability of the industry and stimulate demand for IGE to then proceed with its green hydrogen facility, Arrowsmith, which the company hopes will eventually produce 23 tonnes a day.

“This project, which we can scale up will, we believe, quickly develop the market for us, he said.

“We are targeting mobility, long-haul or back to base trucks because our hydrogen would be competitive with diesel.

“Once we have done that, those customers will come in to Arrowsmith, which is much bigger, and the customer base will open up new avenues for us.”

Immediate returns

IGE first announced plans for Arrowsmith in 2020. It said then it could cost more than $300 million.

The company said it had begun a $3 million capital raise via the issue of 1.5 million new ordinary shares at $2 to proceed the development. It has also applied for $5 million in funds from the WA Investment Attraction Fund.

Founder and CEO Stephen Gauld said the solar farm would immediately generate returns through a power purchase agreement (PPA), and he expected more green hydrogen offtake agreements.

“With the security of a PPA in place, our clear path to initial production in 2024 will demonstrate the plant and help to initiate a market for green hydrogen in the commercial mobility sector in Western Australia,” he said.

“We have our first contracted customer, and six MOUs from other transport companies in Western Australia.”

The deal comes just months after the appointment of Mr Coleman as chairman. Mr Coleman, who left Woodside in 2021 after 10 years at the helm, is a vocal supporter of Australia’s hydrogen potential.

He flagged in April 2021 that he expected to reappear in the corporate world in a role connected with new energy, and carbon.

IGE’s plan comes as heavyweights led by Andrew Forrest, the executive chairman of Fortescue Metals Group, move aggressively into the market.

Fortescue is building an electrolyser in Gladstone, Queensland, which will be able to produce more than 200,000 tonnes of hydrogen a year, according to the company.

Credit: Colin Packham | afr.com